Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual’s ordinary income.

Clients in the 15% or lower tax bracket pay zero income tax on qualified dividends and clients in all but the highest tax bracket pay 15%. This differs from ordinary income and non-qualified dividends that are taxes at the client’s normal tax bracket.

| Dividend Taxation in the United States 2013 + | |

| Ordinary Dividend Tax Rate |

Qualified Dividend Tax Rate |

| 10% | 0% |

| 15% | 0% |

| 25% | 15% |

| 28% | 15% |

| 33% | 15% |

| 35% | 15% |

| 39.6% | 20% |

Qualified dividends are often found in pure stock funds, such as Franklin’s Rising Dividend fund.

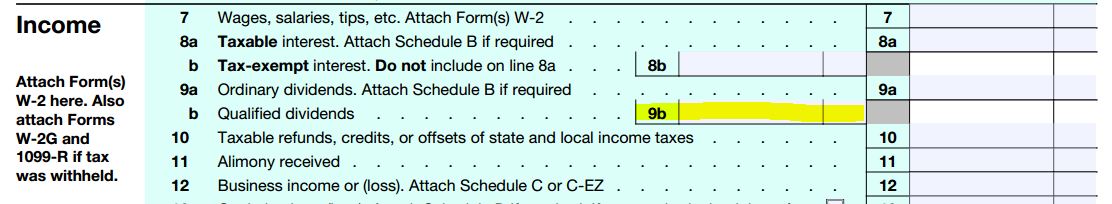

You can see how many of your dividends were considered qualified by looking at your 1040 tax return on line 9b.

If you don’t have an immediate need for income, then moving towards qualified dividends for the growth portion of your portfolio may be a good idea, especially if you are in a high tax bracket.

This information is not intended to be tax advice. Partnervest Advisory Services. LLC does not provide tax advice.

You must be logged in to post a comment.